No Tricks, Just Treats: IDOG’s International Value Portfolio Delivers

November 4, 2025- Last month, the ALPS International Sector Dividend Dogs ETF (IDOG) rallied 3.28%, outpacing US equities and broad international indexes as the fund’s deep-value portfolio of developed international names benefited from new global-focused artificial intelligence (AI) investments and a softer US dollar.

- October’s upside for IDOG was helped by its Information Technology sleeve, as AI-related capital expenditures (CapEx) and partnerships across Europe and other developed markets outside the US lifted value-oriented tech names. Leading IDOG’s Information Technology beneficiaries, global communications company, Nokia Oyj (Nokia FH, 2.93% weight as of 10/31/2025), rallied nearly 42% last month after Nvidia (NVDA, not in IDOG) announced a $1 billion equity stake in the company along with a strategic partnership to develop AI‑enabled RAN/6G platforms; Nokia had already beaten Q3 expectations the prior week on stronger optical/cloud demand tied to AI/data centers. Also moving higher within IDOG’s Information Technology allocation, Swedish telecom group, Ericsson LM (ERICB SS, 2.46% weight as of 10/31/2025), jumped 21.93% last month after posting quarterly earnings above analyst expectations thanks to its cost cutting efforts which aided a large jump in operating margins, as well as announcing a five year partnership with Vodafone (VOD LN, 1.98% weight as of 10/31/2025) to be the sole network vendor for Vodafone across Ireland, the Netherlands and Portugal.

- Finland was a top country contributor in October for IDOG’s sector-balanced portfolio, as easing euro area financial conditions, a softer US dollar and renewed CapEx across Europe—spanning telecom networks/data center (AI) infrastructure and the energy transition segments—lifted Finland’s export-oriented cyclical exposure. Finnish energy group, Neste Oyj (NESTE FH, 2.06% weight as of 10/31/2025), gained over 13% last month after Q3 results topped expectations, with Renewable Products margins improving for a third straight quarter and sustainable aviation fuel (SAF) volumes hitting record levels. Rounding out notable movers in IDOG for October, Polish oil refiner, Orlen SA (PKN PW, 2.35% weight as of 10/31/2025), gained nearly 14% in October after Orlen submitted an offer to buy petrochemical company, Grupa Azoty (ATT PW, not in IDOG) for $279 million—advancing Orlen’s plans of downstream expansion and adding to business lines in the polymers and petrochemicals space—with plans to build the largest plant in central and eastern Europe.

“EAFE [Europe, Australasia and the Far East] Value, especially in dollar terms, has been one of the best-performing asset classes year-to-date. At the same time, by historical standards, the asset class remains cheap.”

– Sebastien Page, Head of Global Multi-Asset and Chief Investment Advisor at T. Rowe Price, October 10, 2025

From Policy Support to Improving Profit Cycles Overseas, the Setup Favors International Value

- With the Federal Reserve easing in October and inflation reports surprising slightly softer, the dollar pulled back slightly to end the month—continuing to provide supportive conditions that typically bolster USD-based returns for developed ex-US equities. Year-to-date (YTD), international developed stocks and the MSCI EAFE Index have followed suit (MSCI EAFE +27.34% YTD through 10/31/2025), with participation broadening beyond defensives as growth expectations stabilize, helped by improving revisions breadth and cyclical participation. Inflation in the euro area has continued to moderate in October, despite a brief September uptick, and fiscal support (EU Recovery Fund disbursement, Germany’s step‑up in real public investment, NATO members' defense and infrastructure spending) is underpinning the catch-up trade for value stocks and cyclical sectors abroad.

- With easing largely baked into international developed markets, the next leg abroad may widen to a broader net of beneficiaries than European banks (24% weight in the MSCI EAFE)—favoring deep-value, income and cyclicals where IDOG is naturally positioned. Moreover, earnings revisions have improved outside the US, and equity exposures for broader EAFE countries continue to offer a higher dividend and buyback yield than US and value stocks, which remain at a steep discount to growth stocks globally. With US index concentration also reaching near historical extremes, investors may continue to diversify into international equities and ex‑US value where valuations remain reasonable paired with improving earnings growth. The ALPS International Sector Dividend Dogs ETF's equal‑weighted sector approach (excluding Real Estate) avoids a ~25% one‑sector bet that many EAFE/international developed funds take in Financials, and instead spreads exposure across cyclicals (Industrials/Materials/Energy) and other undervalued cash‑flow generating sectors, capturing the broader cyclical upswing across the total economy.

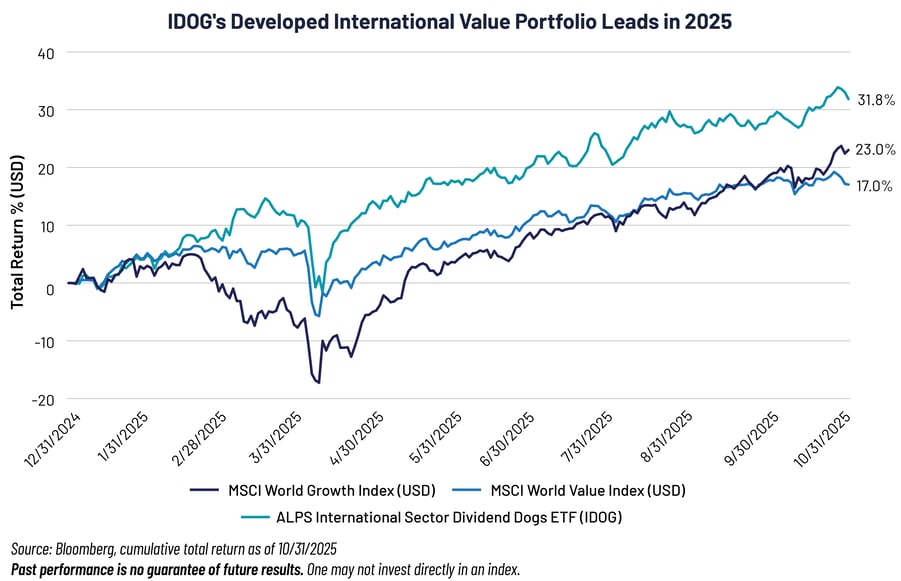

- Year‑to‑date, IDOG is up ~32%, topping global growth and value indices as a softer USD, improving earnings revisions and fiscal/CapEx tailwinds (AI data‑center grids, energy transition) drive a cyclical rebound in developed ex‑US markets—benefiting cheaper, dividend‑rich value stocks and IDOG’s sector‑balanced design.

- IDOG’s deep-value portfolio trades at an attractive 14.3x price-to-earnings (P/E) ratio, materially cheaper than both the MSCI World Value Index P/E of 18.4x and the MSCI World Growth Index P/E of 34.0x.

Performance Summary

| Cumulative | Annualized |

|||||||

| 1 M | YTD | 1 Y | 3 Y | 1 Y | 5 Y | 10 Y | SI | |

| IDOG - NAV (Net Asset Value) | 3.28% | 31.85% | 26.69% | 84.10% | 16.94% | 15.54% | 8.93% | 7.36% |

| IDOG - Market Price | 3.39% | 32.31% | 27.03% | 85.25% | 16.98% | 15.68% | 8.97% | 7.40% |

| S-Network International Sector Dividend Dogs Index - NTR | 3.31% | 32.24% | 27.22% | 86.55% | 17.42% | 16.00% | 9.36% | 7.78% |

| Morningstar Developed Markets ex-North America Index - NTR | 0.95% | 26.74% | 23.33% | 71.96% | 15.34% | 10.69% | 8.07% | 7.15% |

Source: Bloomberg L.P. and SS&C ALPS Advisors, cumulative performance as of 10/31/2025 and annualized performance as of 09/30/2025

Performance data quoted represents past performance. Past performance is no guarantee of future results so that shares, when redeemed, may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For current month-end performance call 1-866-759-5679 or visit www.alpsfunds.com. Performance includes reinvested distributions and capital gains.

Market Price is based on the midpoint of the bid/ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times.

Fund inception date: 06/27/2013

Total Operating Expenses: 0.50%

Top 10 Holdings

| Nokia Oyj | 2.93% | Rio Tinto PLC | 2.25% | |

| Telefonaktiebolaget LM Ericsso | 2.47% | GSK PLC | 2.24% | |

| Kering SA | 2.43% | Fortescue Ltd | 2.16% | |

| Fortum Oyj | 2.43% | Enel SpA | 2.14% | |

| ORLEN SA | 2.36% | Japan Tobacco Inc | 2.11% |

As of 10/31/2025, subject to change

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus containing this and other information, call 1-866-759-5679 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemable.

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

All investments are subject to risks, including the loss of money and the possible loss of the entire principal amount invested. Additional information regarding the risks of this investment is available in the prospectus.

The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector.

Diversification does not eliminate the risk of experiencing investment losses.

The Fund’s investments in non-US issuers may involve unique risks compared to investing in securities of US issuers, including, among others, less liquidity generally, greater market volatility than US securities and less complete financial information than for US issuers. In addition, adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Finally, the value of the currency of the country in which the Fund has invested could decline relative to the value of the US dollar, which may affect the value of the investment to US investors.

The Fund employs a “passive management” - or indexing - investment approach and seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell or buy a security unless that security is removed from or added to the underlying index, respectively.

Capital Expenditures (CAPEX/Capex/CapEx): refers to investments in physical assets such as plant and machinery.

Morningstar Developed Markets ex-North America Index: measures the performance of companies in developed markets ex-North America. It covers approximately 97% of the full market capitalization in the Developed Markets ex-North America.

MSCI EAFE Index: an equity index which captures large- and mid-cap representation across 21 developed markets countries around the world, excluding the US and Canada, covering approximately 85% of the free float-adjusted market capitalization in each country.

MSCI World Growth Index: captures large- and mid-cap securities exhibiting overall growth style characteristics across Developed Markets countries.

MSCI World Value Index: captures large- and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries.

Price/Earnings (P/E) Ratio: a valuation ratio of a company's current share price compared to its per-share earnings.

S-Network International Sector Dividend Dogs Index (IDOGX): a portfolio of stocks derived from a universe of mainly large capitalization stocks domiciled in developed markets outside the Americas (the “S-Network Developed International Equity 1000 Index”). The IDOGX methodology selects the five stocks in each of the ten GICS sectors that make up the universe which offer the highest dividend yields as of the last trading day of November. The fifty stocks that are selected for inclusion in the portfolio are equally weighted.

Tailwind: a certain situation or condition that may lead to higher profits, revenue or growth.

One may not invest directly in an index.

ALPS Advisors, Inc., registered investment adviser with the SEC, is the investment adviser to the Fund. ALPS Advisors, Inc. is affiliated with ALPS Portfolio Solutions Distributor, Inc.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the Fund.

Not FDIC Insured • No Bank Guarantee • May Lose Value

DOG001524 02/28/2026