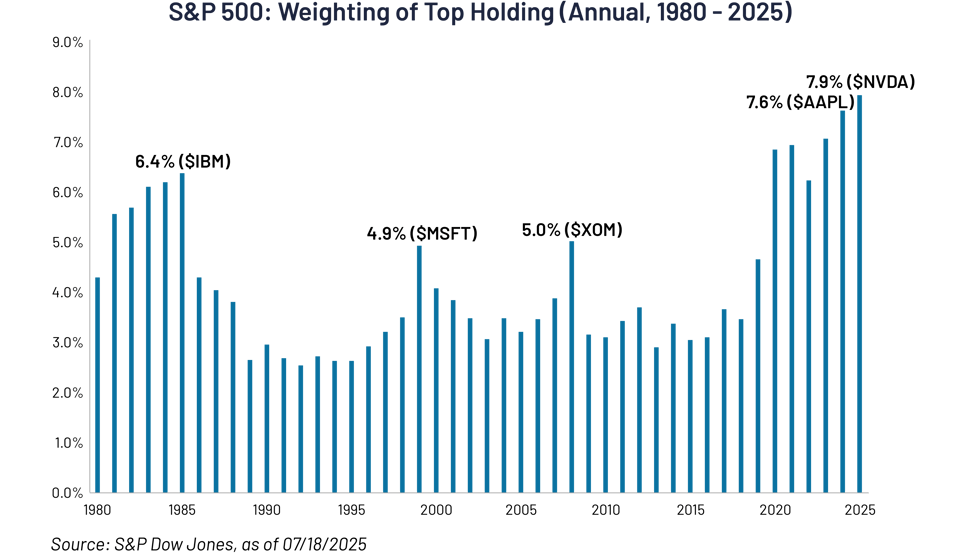

- Last month, despite the Technology sector once again leading monthly returns, the ALPS Equal Sector Weight ETF (EQL) mostly kept pace with the S&P 500 Index, where the Technology sector now represents 34% of the Fund1 – an unnerving record high. Year-to-date, the top five names by market-cap in the S&P 500 have produced 67% of the index returns.1

- Notably, thanks to its methodology that equally weights each of the Sector SPDR ETFs, EQL is overweight the Utilities, Industrials and Energy sectors that contributed positively to the Fund in July, as investors rotated into adjacent sectors that are benefitting from the unwavering buildout of Artificial Intelligence (AI) data centers.

"Breadth is finally expanding, and returns are spreading out down the market-cap spectrum as well as across different sectors and industries.”

– Joey Del Guercio, Market Strategy at Raymond James

- Concentration risk remains elevated in the S&P 500 with its heavy growth tilt to the Technology sector and the Magnificent 7 stocks (Apple, Amazon, Microsoft, Amazon, Tesla, Google and Nvidia), each representing nearly 34% of the Fund.1 EQL positions investors for a potential broadening-out of equity returns on any rotation to more cyclical or defensive sectors. Defensive and cyclical sectors tend to perform better in times of rising inflation or with a rotation to value stocks, which have been disproportionately left behind in a momentum-based rally.

July Sector Leaders in EQL

Utilities (+6.91% overweight* in EQL)

- The Utilities Select Sector SPDR (XLU, 9.38% weight**) returned 4.94% in July, as the spending spree to upgrade America’s electric grid to satisfy the massive AI data center power needs has resulted in investors becoming very bullish on the growth prospects for Utilities and Independent Power Producers going forward.

Energy (+5.65% overweight* in EQL)

- The Energy Select Sector SPDR (XLE, 8.67% weight**) returned 2.70% in July, as natural gas-focused energy companies rallied on a slew of new natural gas pipeline projects and gas rigs being deployed to satisfy the exponential increase in power demand from the AI data centers being built across the US.

Industrials (+0.81% overweight* in EQL)

- The Industrial Select Sector SPDR (XLI, 9.44% weight**) returned 3.01% in July, as many underlying Industrial sub-industries (like Heavy Electrical Equipment, Electrical Components and Construction Machinery, etc.) rallied on the AI data center buildout in the US, with several new large data centers being announced in the month of July.

The ALPS Equal Sector Weight ETF (EQL) may be a prudent way to pare back the concentration risk in the core (S&P 500) allocation, while still maintaining the market-cap weighted tilts within each Sector SPDR ETF to ensure investors are appropriately exposed to the leaders within each sector.

Performance Summary

| |

Cumulative |

Annualized

|

| |

1 M |

YTD |

1 Y |

3 Y |

1 Y |

3 Y |

5 Y |

10 Y |

SI |

| EQL - NAV (Net Asset Value) |

0.95% |

6.93% |

11.06% |

40.16% |

13.60% |

14.34% |

14.84% |

11.32% |

13.26% |

| EQL - Market Price |

0.92% |

6.88% |

10.91% |

39.64% |

13.57% |

14.34% |

14.80% |

11.31% |

13.26% |

| NYSE Equal Sector Weight Index - TR |

0.96% |

7.03% |

11.27% |

40.76% |

13.80% |

14.50% |

15.00% |

11.49% |

13.50% |

| S&P 500 Index - TR |

2.24% |

8.58% |

16.31% |

60.95% |

15.16% |

19.71% |

16.64% |

13.65% |

15.02% |

Source: Bloomberg L.P. and SS&C ALPS Advisors, cumulative performance as of 07/31/2025 and annualized performance as of 06/30/2025

Performance data quoted represents past performance. Past performance is no guarantee of future results so that shares, when redeemed, may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For current month-end performance call 1-866-759-5679 or visit www.alpsfunds.com. Performance includes reinvested distributions and capital gains.

Market Price is based on the midpoint of the bid/ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times.

Fund inception date: 07/06/2009

Total Operating Expenses: 0.45%; What You Pay: 0.25% (reflects the Adviser’s decision to contractually limit expenses through 3/31/2026, please see the prospectus for additional information).

1 Source: Bloomberg, as of 07/31/2025

* Source: Bloomberg, EQL relative to the S&P 500 Index, as of 07/31/2025

** Weight in EQL as of 07/31/2025

Top 10 Holdings

| Technology Select Sector SPDR Fund |

9.66% |

|

Financial Select Sector SPDR Fund |

9.19% |

| Industrial Select Sector SPDR Fund |

9.44% |

|

Materials Select Sector SPDR Fund |

8.98% |

| Utilities Select Sector SPDR Fund |

9.38% |

|

Real Estate Select Sector SPDR Fund |

8.75% |

| Consumer Discretionary Select Sector SPDR Fund |

9.29% |

|

Consumer Staples Select Sector SPDR Fund |

8.71% |

| Communication Services Select Sector SPDR Fund |

9.24% |

|

Health Care Select Sector SPDR Fund |

8.70% |

As of 07/31/2025, subject to change

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus containing this and other information, call 1-866-759-5679 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemable.

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

All investments are subject to risks, including the loss of money and the possible loss of the entire principal amount invested. Additional information regarding the risks of this investment is available in the prospectus.

The Fund’s investment performance, because it is a fund of funds, depends on the investment performance of the Underlying Sector ETFs in which it invests.

An investment in the Fund is subject to the risks associated with the Underlying Sector ETFs that comprise the Underlying Index. The Fund will indirectly pay a proportional share of the asset-based fees of the Underlying Sector ETFs in which it invests.

The Fund employs a “passive management” - or indexing - investment approach and seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell or buy a security unless that security is removed from or added to the underlying index, respectively.

NYSE Equal Sector Weight Index: consists of a strategy that holds all active Select Sector® SPDR® ETFs in an equal-weighted portfolio.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

ALPS Advisors, Inc., registered investment adviser with the SEC, is the investment adviser to the Fund. ALPS Advisors, Inc. is affiliated with ALPS Portfolio Solutions Distributor, Inc.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the Fund.

Not FDIC Insured • No Bank Guarantee • May Lose Value

EQL000403 11/30/2025