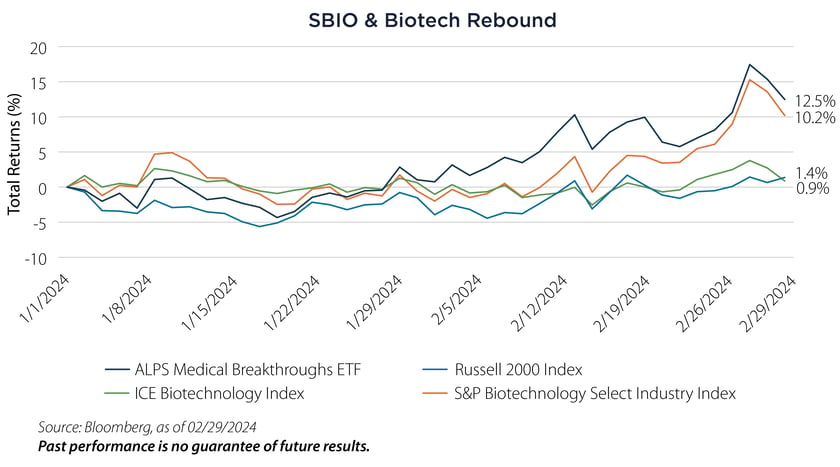

“As long as market breadth allows for improved returns across small-cap equities, Biotech may move even higher, especially if the M&A backdrop remains robust.”

– Mizuho Analyst, February 28, 2024

Despite years of improving cash on hand, active M&A and continual improvements in life-saving therapies, biotech stocks have been treated as an unloved segment of the market. However, recent momentum and a rising IPO surge in biotech so far in 2024 suggest the tide is turning. The realization of substantial future growth prospects across weight loss drugs, cancer treatments and other immunotherapy-focused breakthroughs will undoubtedly improve sentiment for SMid-cap biotechnology names as large biopharma companies scramble to acquire later-stage therapies to help lessen the impact from many of their branded drugs losing revenue to generics and biosimilars.

Per Jefferies, biotech names have attracted more than $6 billion in follow-on financing since the start of the year through mid-February - a record-setting pace—one that has already exceeded each quarterly amount recorded since the second quarter of 2021. The opportunity for further drug advancement and realization of M&A premiums has mostly been focused on more established SMid-cap biotech companies that have later-stage (Phase II and Phase III) drugs under development, the sweet spot of where SBIO is positioned for investors.

| Cumulative | Annualized |

|||||||

| 1 M | YTD | 1 Y | 3 Y | 1 Y | 3 Y | 5 Y | SI | |

| SBIO - NAV (Net Asset Value) | 11.41% | 12.13% | 22.19% | -33.05% | 8.17% | -13.67% | 3.17% | 3.82% |

| SBIO - Market Price | 11.64% | 12.47% | 22.61% | -32.69% | 8.24% | -13.69% | 3.28% | 3.82% |

| S-Network Medical Breakthroughs Index - TR | 11.37% | 12.13% | 22.45% | -32.08% | 8.39% | -13.25% | 3.58% | 4.21% |

| NASDAQ Biotechnology Index - TR | 1.12% | 1.46% | 9.57% | -8.13% | 4.59% | -2.03% | 8.26% | 4.18% |

Source: Bloomberg L.P. and SS&C ALPS Advisors, cumulative performance as of 02/29/2024 and annualized performance as of 12/31/2023

Performance data quoted represents past performance. Past performance is no guarantee of future results so that shares, when redeemed, may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For current month-end performance call 1-866-759-5679 or visit www.alpsfunds.com. Performance includes reinvested distributions and capital gains.

Market Price is based on the midpoint of the bid/ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times.

Fund inception date: 12/30/2014

Total Operating Expenses: 0.50%

* Weight in SBIO as of 02/29/2024

**DREEN: Dermatology, Respiratory, Eye, Ear, Neurology

Top 10 Holdings

| Viking Therapeutics Inc | 4.63% | Axsome Therapeutics Inc | 2.39% | |

| Vaxcyte Inc | 4.38% | ACADIA Pharmaceuticals Inc | 2.36% | |

| Cerevel Therapeutics Holdings Inc | 3.63% | Cymabay Therapeutics Inc | 2.20% | |

| Alkermes PLC | 3.15% | Summit Therapeutics Inc | 2.19% | |

| REVOLUTION Medicines Inc | 2.97% | Xenon Pharmaceuticals Inc | 2.17% |

As of 02/29/2024, subject to change

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus containing this and other information, call 1-866-759-5679 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemable.

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

All investments are subject to risks, including the loss of money and the possible loss of the entire principal amount invested. Additional information regarding the risks of this investment is available in the prospectus.

The Fund’s investments are concentrated in the pharmaceuticals and biotechnology industries, and underperformance in these areas will result in underperformance in the Fund. Investments in small and micro capitalization companies are more volatile than companies with larger market capitalizations. Companies in the pharmaceuticals and biotechnology industry may be subject to extensive litigation based on product liability and similar claims. Legislation introduced or considered by certain governments on such industries or on the healthcare sector cannot be predicted.

Companies in the pharmaceuticals industry are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting. The profitability of some companies in the pharmaceuticals industry may be dependent on a relatively limited number of products. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. Many new products in the pharmaceuticals industry are subject to government approvals, regulation and reimbursement rates. The process of obtaining government approvals may be long and costly. Many companies in the pharmaceuticals industry are heavily dependent on patents and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies.

The development of new drugs generally has a high failure rate, and such failures may negatively impact the stock price of the company developing the failed drug. Biotechnology companies may have persistent losses during a new product’s transition from development to production. In order to fund operations, biotechnology companies may require financing from the capital markets, which may not always be available on satisfactory terms or at all.

The Fund is considered nondiversified and as a result may experience greater volatility than a diversified fund.

The Fund employs a “passive management” - or indexing - investment approach and seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell or buy a security unless that security is removed from or added to the underlying index, respectively.

Basis Point (bps): a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

ICE Biotechnology Index: a rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of qualifying US listed biotechnology companies.

NASDAQ Biotechnology Index: designed to track the performance of a set of securities listed on The NASDAQ Stock Market (NASDAQ) that are classified as either biotechnology or pharmaceutical companies, and is a modified market capitalization weighted index.

NYSE Biotechnology Index: a rules-based, modified float-adjusted market capitalization-weighted equity index that has the objective of measuring the performance of US-listed companies in the biotechnology sector.

Russell 2000 Index: measures the performance of the small-cap segment of the US equity universe.

S-Network Medical Breakthroughs Index: comprised of small and mid-cap stocks of biotechnology companies that have one or more drugs in either Phase II or Phase III of the US Food and Drug Administration (“FDA”) clinical trials.

S&P Biotechnology Select Industry Index: comprises stocks in the S&P Total Market Index that are classified in the GICS biotechnology sub-industry.

One may not invest directly in an index.

ALPS Advisors, Inc., registered investment adviser with the SEC, is the investment adviser to the Fund. ALPS Advisors, Inc. is affiliated with ALPS Portfolio Solutions Distributor, Inc.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the Fund.

Not FDIC Insured • No Bank Guarantee • May Lose Value

SMB000460 06/30/2024